The state of staffing: Bullhorn CEO Art Papas on the economic trends shaping the industry

While the past few years have held incredible growth for the staffing industry, firms have recently seen weakening demand. Coupled with the turmoil in the financial markets and macroeconomic uncertainty as policymakers wrestle with inflation, staffing industry leaders may be asking: What does the future hold?

Bullhorn CEO and founder Art Papas is taking the long view – and it’s an optimistic one. This month, he spoke with Jeff Silber, Managing Director at BMO Capital Markets Equity Research, on the state of the staffing industry. Building on his 24 years of staffing experience, Papas offers his thoughts on how he’s seen firms find success, emerging models in staffing, and how automation and AI are changing the game.

Staffing industry trends: Unpacking the data

Bullhorn began tracking trends in the staffing industry through the Bullhorn | SIA Staffing Indicator during the 2020 pandemic lockdowns. While the Bureau of Labor Statistics releases employment data monthly, the team at Bullhorn wanted a snapshot in near-real time, compiled and extrapolated from aggregated data and analyzed by the team at SIA. The indicator tracks hours worked each week, time cards submitted each week, and how many hours were worked in the week.

During the start of the pandemic, there was a decline in hours worked, but by the summer of 2020, hours were increasing quickly. That growth continued in 2021 and the first half of 2022, and the hours worked increased far beyond the pre-pandemic peak. “We called that the post-recession snapback recovery,” Papas said. At the end of last year, the indicator revealed a slowdown, and in January, began to show negative growth. However, in February, the deceleration seemed to have leveled off.

Short-term ebbs and flows aside, throughout the two decades he’s been in staffing, Papas said, there have only been a few periods during which the industry wasn’t growing. “Nobody is saying that it’s really bad, which you would hear in a downturn.” With this resilience and the shifting trends towards contingent labor, Papas remains optimistic: “Long-term, [I’m] extremely bullish on demand for labor.”

That’s because staffing services are playing a more strategic role, filling critical talent in roles in IT, finance, and cybersecurity – to the extent that professional roles comprise over 60% of revenue in the staffing industry, as compared to half that 20 years ago. Papas noted that while some firms are feeling the pinch at the moment, in other sectors, demand remains high. “It’s a sector-driven market right now rather than overall…declining labor demand,” he said, noting that while light industrial and clerical work is slower, demand for IT and professional staffing is strong.

Staffing best practices: Learning from top performers

Leveraging metrics and reporting plays a considerable role in an organization’s success, noted Papas: “The best-run staffing businesses focus on building a culture of high performance on the sales side and the recruiting side.” Pairing a growth-driven culture with tech is also a hallmark of leading staffing organizations. “How do I automate mundane activities? It’s a mix of tech and touch,” said Papas. “I do think the industry is driven by a disciplined focus on metrics and analytics and bolstered by technology that serves as a force multiplier for the talent they have working for them.”

Still, at its heart, recruitment is a people-driven business. “It’s very much about forming relationships with clients and talent and trying to match-make,” said Papas. The majority of placements made are longer-term assignments. As a result, personal connection remains essential to the staffing industry, and technology only helps to strengthen relationships: “Even the ones that bill themselves as a digital staffing platform – if you look under the hood, they do have a human element.”

Outlook for the future: Identifying threats and opportunities

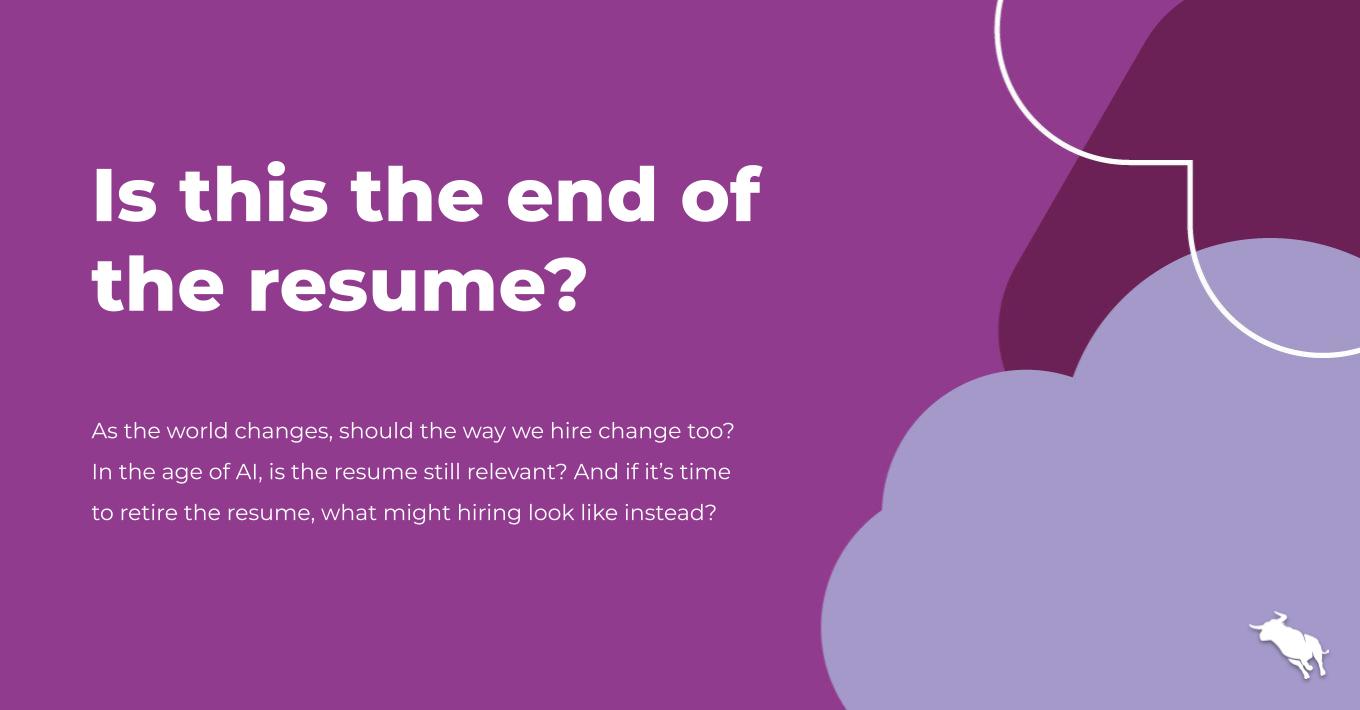

While traditional staffing businesses continue to see growth, digital-only staffing platforms are increasingly prevalent. Papas doesn’t see this as an existential threat: “I think all staffing firms will have to be digital, to have a self-service component. Not every candidate wants to engage with a recruiter and have a conversation while in the initial discovery phase of an opportunity.” The key is in finding the right way to engage a candidate at the right time.

With this rise in tech come new advancements in AI, like ChatGPT. Papas similarly sees these as tools to be leveraged by staffing firms rather than as a replacement. “We work with some of the biggest players in the industry, and they see what’s going on with digital. I think all of them are aware there is leverage in tech. How do they get a differentiated advantage using automation? How do they use AI? They’re all looking at these models and thinking about what works well.”

Papas has also seen a shift from front-office tech into middle and back-office services, like time capture, onboarding, and billing, providing its own unique set of challenges. “That’s harder than building a database of jobs and talent and providing matching on top of that because you’re getting into compliance,” he said. Tailoring products to stay compliant with rules in each state and country, like overtime laws and break exceptions, is difficult. At the same time, offering solutions for middle and back-office is high-value, given that many of these processes as they exist today are manual, done either in spreadsheets or by hand.

Overall, Papas sees the staffing industry of the future looking much like it does today, only with the adoption of more digital tools, like automation and AI. “All the tailwinds are in favor of a shift toward contingent labor and from lower-wage jobs to higher-wage jobs,” he added. It’s been a few years of solid growth in staffing, and despite the uncertainty of the current moment, the future looks to hold even further success.