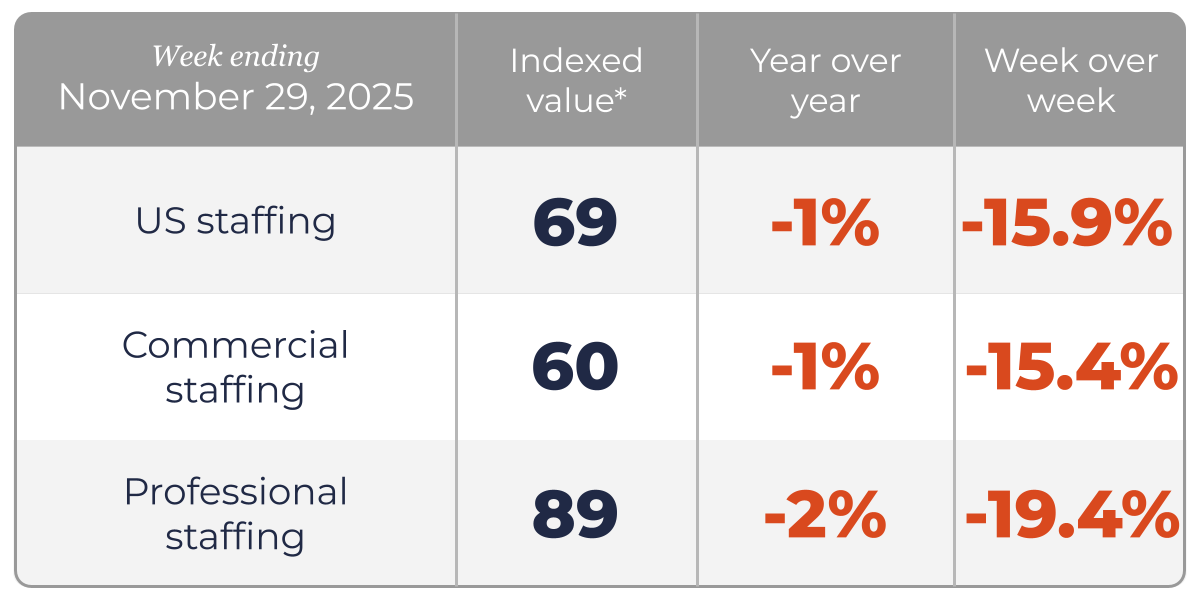

Staffing hours fall due to Thanksgiving

Staffing hours in all sectors fell due to the short holiday week. The sequential decline was in line with last year’s trends and normal for the season. U.S. staffing hours were down 15.9%, commercial hours were down 15.4%, and professional hours, typically the most heavily affected by holidays, were down 19.4%.

**Indexed value of US staffing hours benchmarked against the week ending January 19, 2019.

Staffing Industry Analysts' perspective

The Professional Staffing indexed value was 89 for the week ending November 29th, following readings of 110 and 106 in the prior two weeks (ending Nov 22nd and Nov 15th, respectively.)

The Commercial Staffing indexed value was 60 for the same week, following values of 71 and 69 in the prior two weeks.

The US Staffing indexed value, weighted to reflect the US staffing industry mix of professional and commercial jobs, was 69 for the week ending November 29th, following readings of 82 and 80 in the prior two weeks, as shown in the interactive chart above.

The US staffing industry is a large and dynamic market that continues to offer big opportunities

US Staffing hours were only -1% down compared to the same week a year ago, improving further when compared with the year-over-year changes observed in the previous weeks.

On a sequential, week-over-week basis, hours dropped sharply, impacted by the Thanksgiving holiday-related business closures. The prior week, hours had edged up in the final week of the seasonal ramp that is typically capped between Labor Day and Thanksgiving. Both Commercial hours and Professional hours reached new Year-To-Date peak levels.

The outlook for temporary staffing remains clouded by factors such as slowing growth in the overall US labor market, high interest rates, policy uncertainty, and uncertainty regarding the impact of AI, leading to a continued cautious approach to hiring from clients.

Nevertheless, we highlight that elevated levels of uncertainty for staffing clients means a stronger value proposition for the use of a flexible or contingent workforce to help navigate fluctuations in business activity. For more insights, please see our US Economic and Labor Market Trends (November 2025), our November US Jobs Report Briefing and our most recent US Staffing Industry Forecast Update.

About the SIA Bullhorn Staffing Industry Indicator

The SIA | Bullhorn Staffing Indicator is a unique tool for gauging near real time weekly trends in the volume of temporary staffing delivered by US staffing firms. Each week the Indicator reports data for the week that ended ten days prior to the release. It reflects weekly hours worked by temporary workers across a sample of staffing companies in the US that utilize Bullhorn’s technology solutions. The Indicator is weighted and benchmarked against US Bureau of Labor Statistics data to approximate the composition of the staffing industry by skill. While the indicator does not presume to perfectly reflect the entire universe of US staffing firms, it does represent a sizable sample of the US staffing industry, reflecting a wide range of occupations, client industry verticals, and geographic footprint that spans the country.

The Indicator can be used by staffing firms to benchmark their past and current performance, as well as a tool for forecasting near term industry trends and outlook.

As the US temporary staffing industry has often functioned as a co-incident indicator for the US labor market and economy, the SIA | Bullhorn Staffing Indicator is also useful for a broader audience of business leaders and investors who are seeking real-time insight.

The Indicator is a joint custom research effort between Bullhorn and industry advisor Staffing Industry Analysts.

Revisions and Technical notes on the SIA | Bullhorn Staffing Indicator

We note the readings for the last 4 weeks are subject to revision and so should be viewed as preliminary, with the reading for the last recorded week the most likely to be revised in next week’s data release. For further information on how the Indicator has been created and detailed technical notes please refer to the methodology.