What is top of mind for light industrial firms in 2024?

Like the rest of the industry (and the world) the economy looms large as the biggest concern for LI staffing firms. But it is interesting that over one-third are also concerned about competition from gig platforms, up from 13% last year, a signal that the market is at an inflection point when it comes to the changing nature of employment and the way that workers want to engage with contingent work opportunities. This is similar in theme to the one-fourth of firms that are worried about workers shifting to non-traditional labor models as they seek greater flexibility and work/life balance. So, the overall message is that there is a challenging economic backdrop and a shifting labor market with continued talent shortages.

How do light industrial firms differ from other industries?

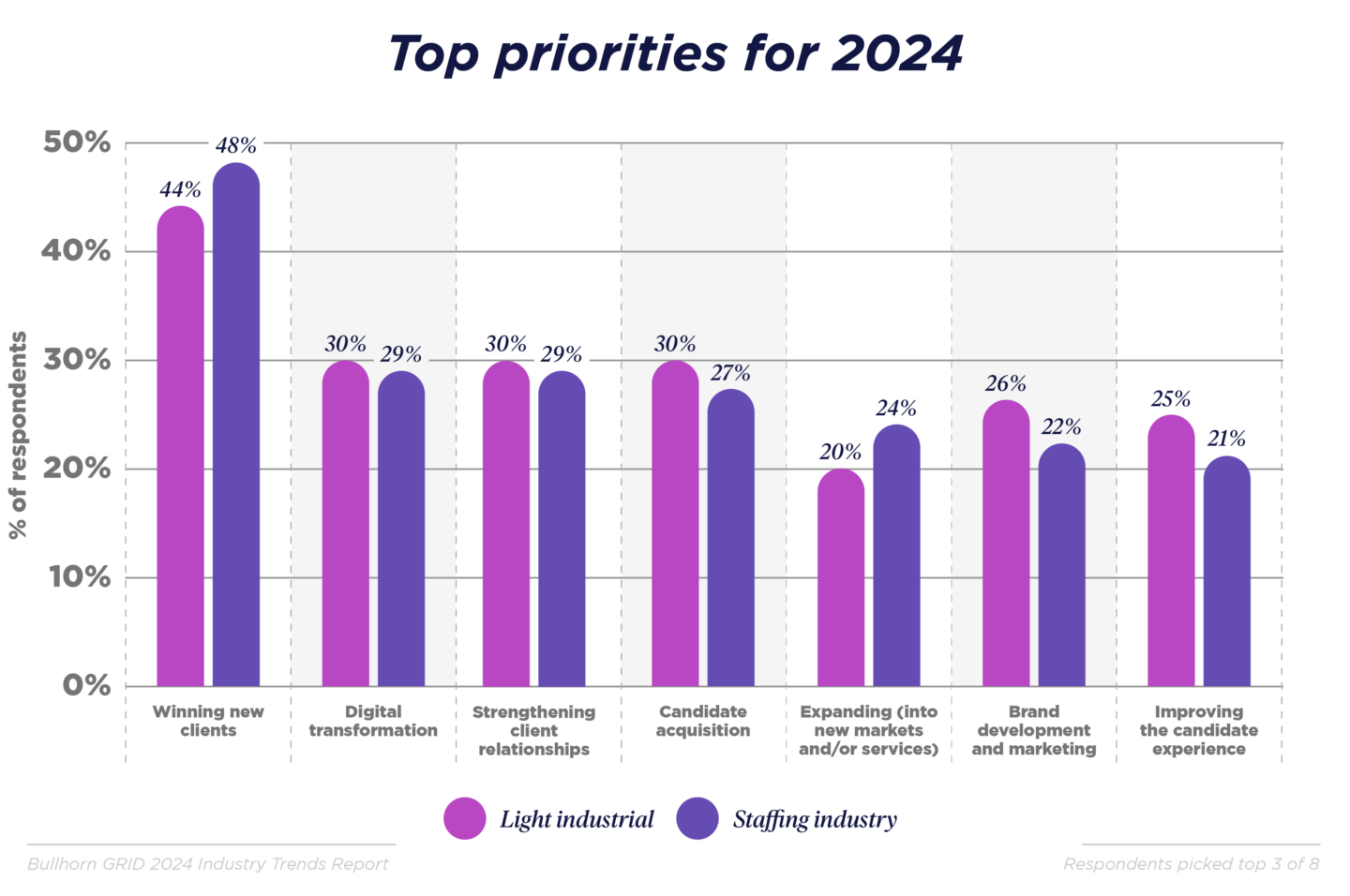

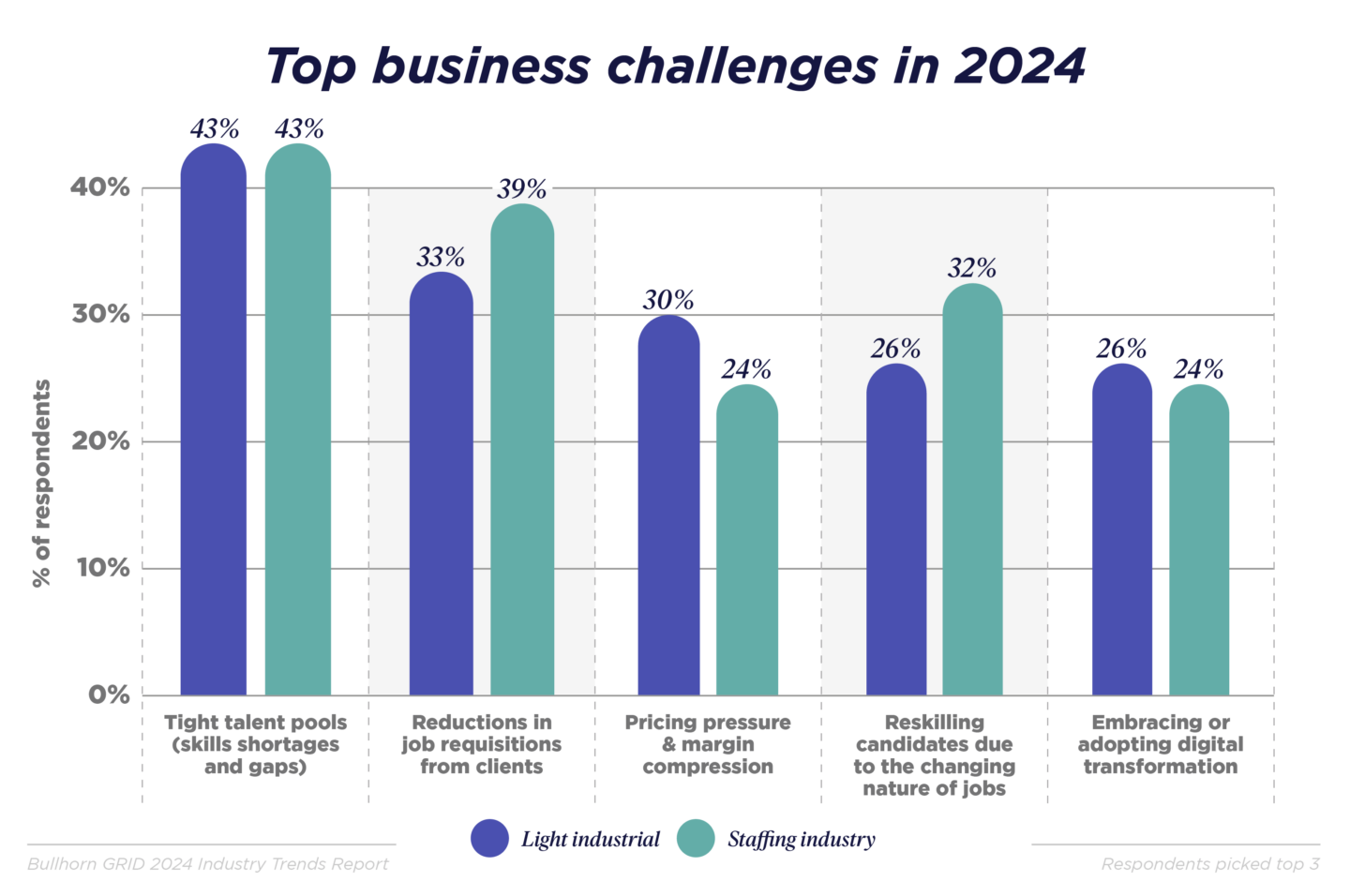

Light industrial firms are less likely than the staffing industry as a whole to see reduced job requisitions as a top challenge for 2024, but they are more likely to cite this reduction as a key obstacle to winning new business. This is a particular concern since light industrial firms more strongly emphasize winning new clients as a top priority for 2024 and are feeling the pinch of margin compression.

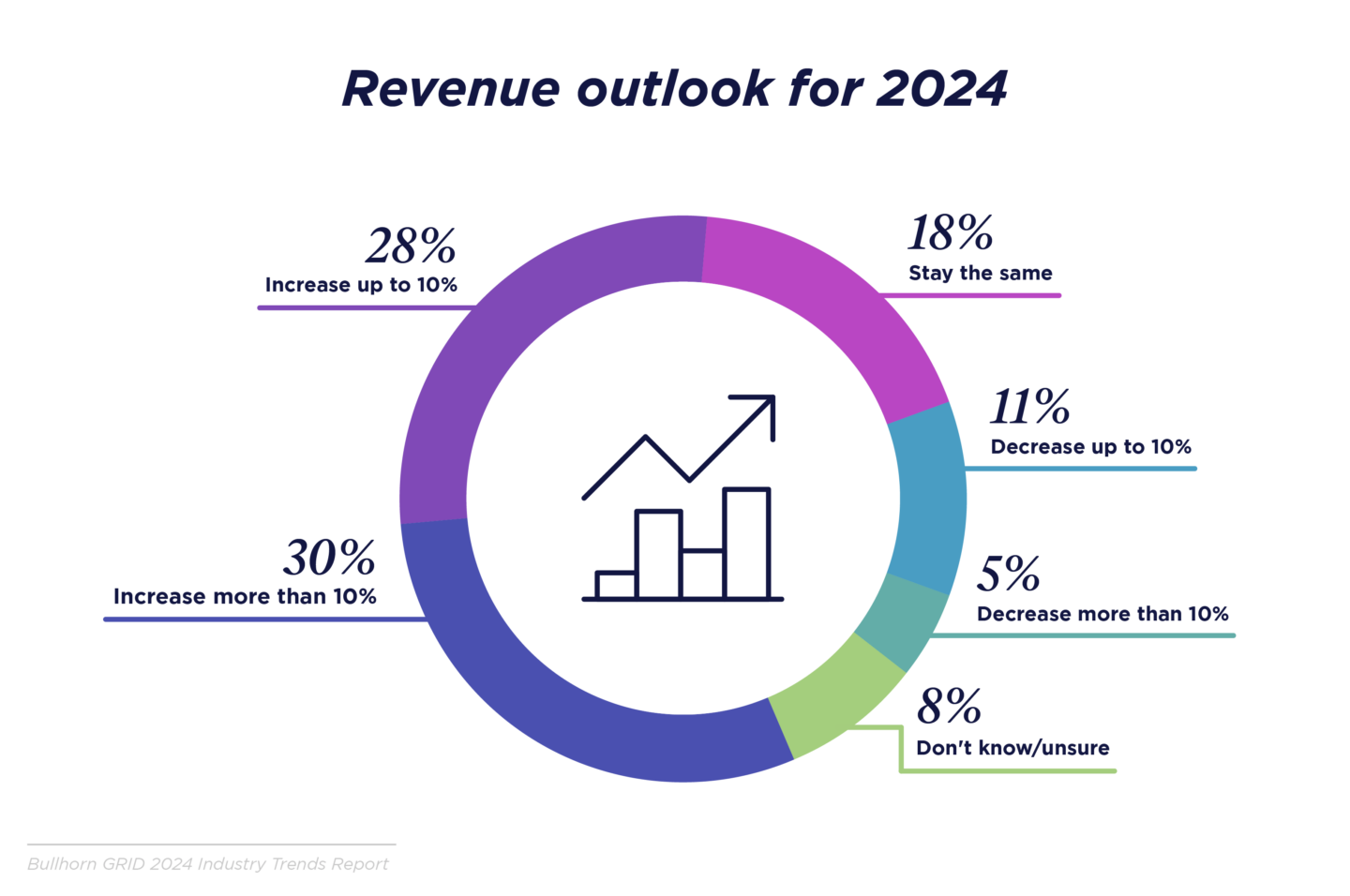

Industry and economic outlook

2023 was a challenging year for the staffing industry overall, but in spite of that, more than half of light industrial staffing firms saw revenue growth in 2023. Most remain optimistic about revenue prospects in 2024, although it is worth acknowledging that some of that optimism has dampened as the global economy has remained sluggish into the second quarter of the year.

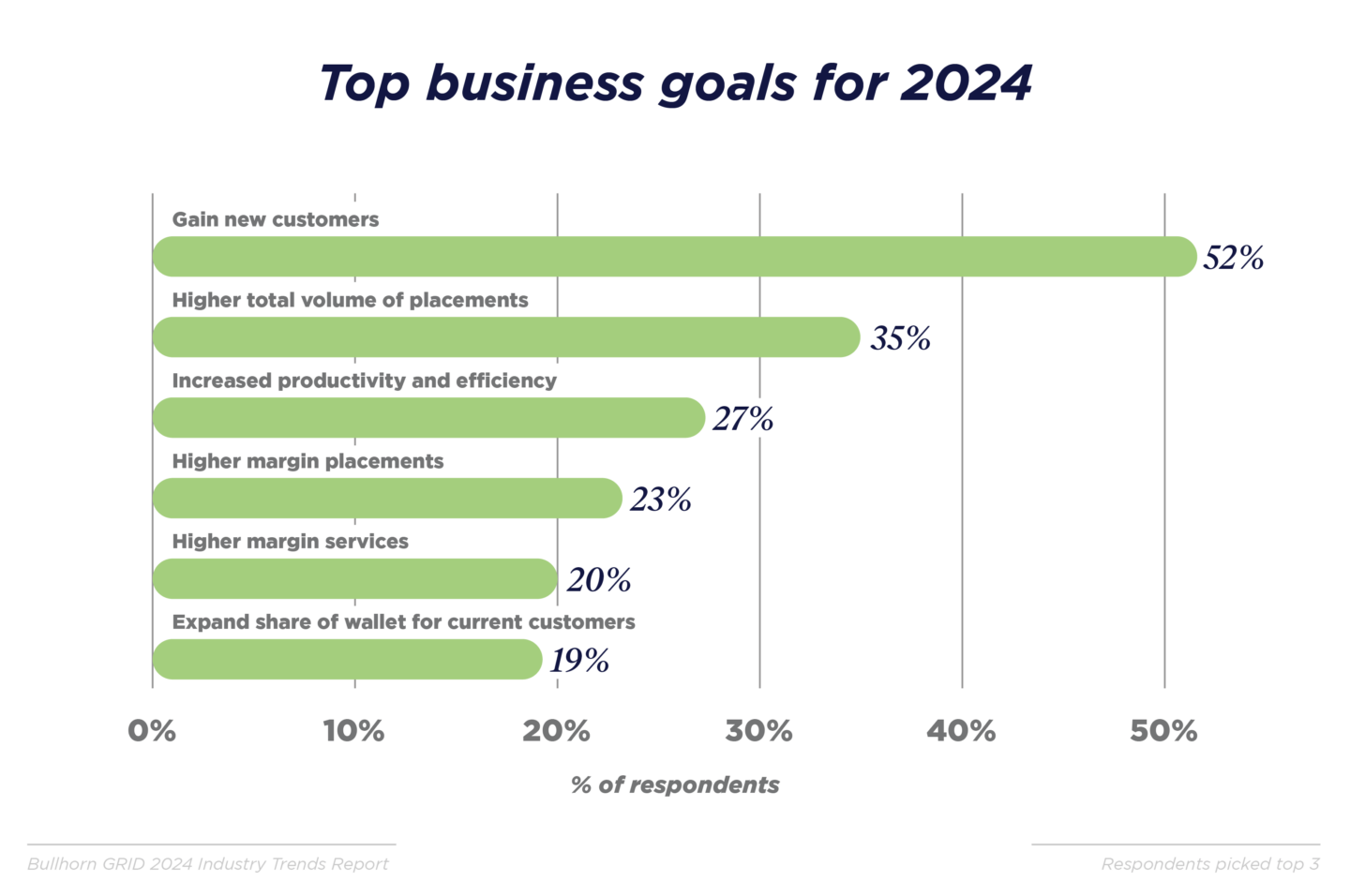

Increasing number of customers, not just job volume, is top goal

Gaining new customers is the top goal for light industrial firms, as it was across the industry, but it seems notable that the gap between this and the next highest business goal is dramatic. It is more important to LI firms to increase their overall number of clients than it is to add to their volume of placements with current customers. A critical mass of different customers is more important than just volumes to better position firms to capitalize when customers increase hiring levels. This reflects a market-wide trend in which staffing firms say they are focusing on using this time to gain share as a springboard to financial gains when the upturn comes.

But firms should consider the crucial role efficiency plays in the capacity to win new business. More than 60% of the firms that spend less than half their time working with existing customers saw revenue gains in 2023. Recruiters need time to go after new customers, which means increasing productivity, usually through tools like automation that can allow them to do so.

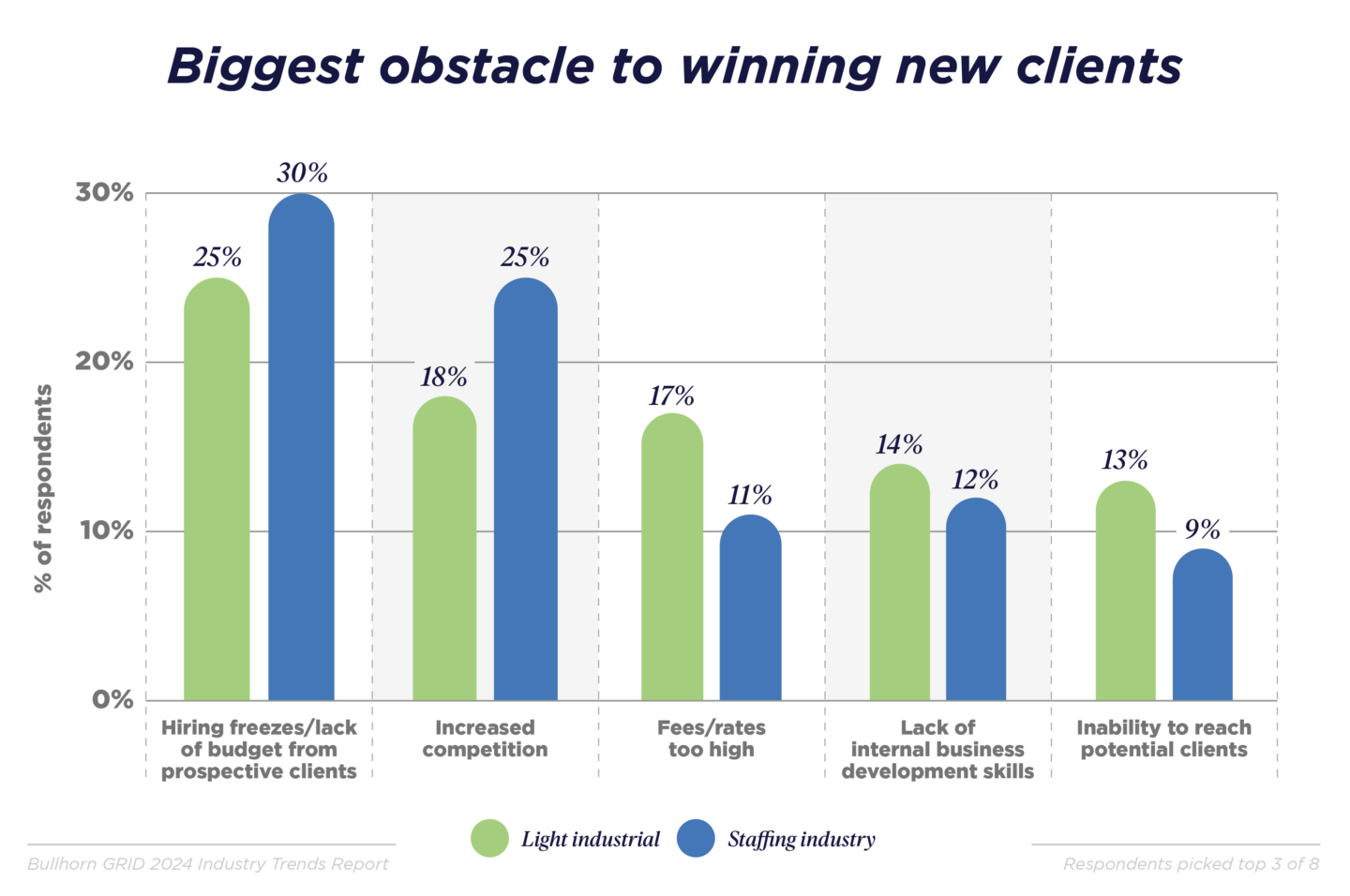

Hiring freezes are biggest obstacle to winning new business

25% of firms shared that hiring freezes were the biggest obstacle to winning new clients in 2023, a little bit lower than the rate seen in the overall GRID sample (30%), with increased competition in second place. When compared to the industry, LI firms were more than 50% more likely to say high bill rates were a factor in their inability to win new clients, implying more price competition in this part of the market, making it all the more important for LI staffing firms to differentiate themselves on value rather than sacrificing margin to win business.

Speeding up conversion is a key strategy

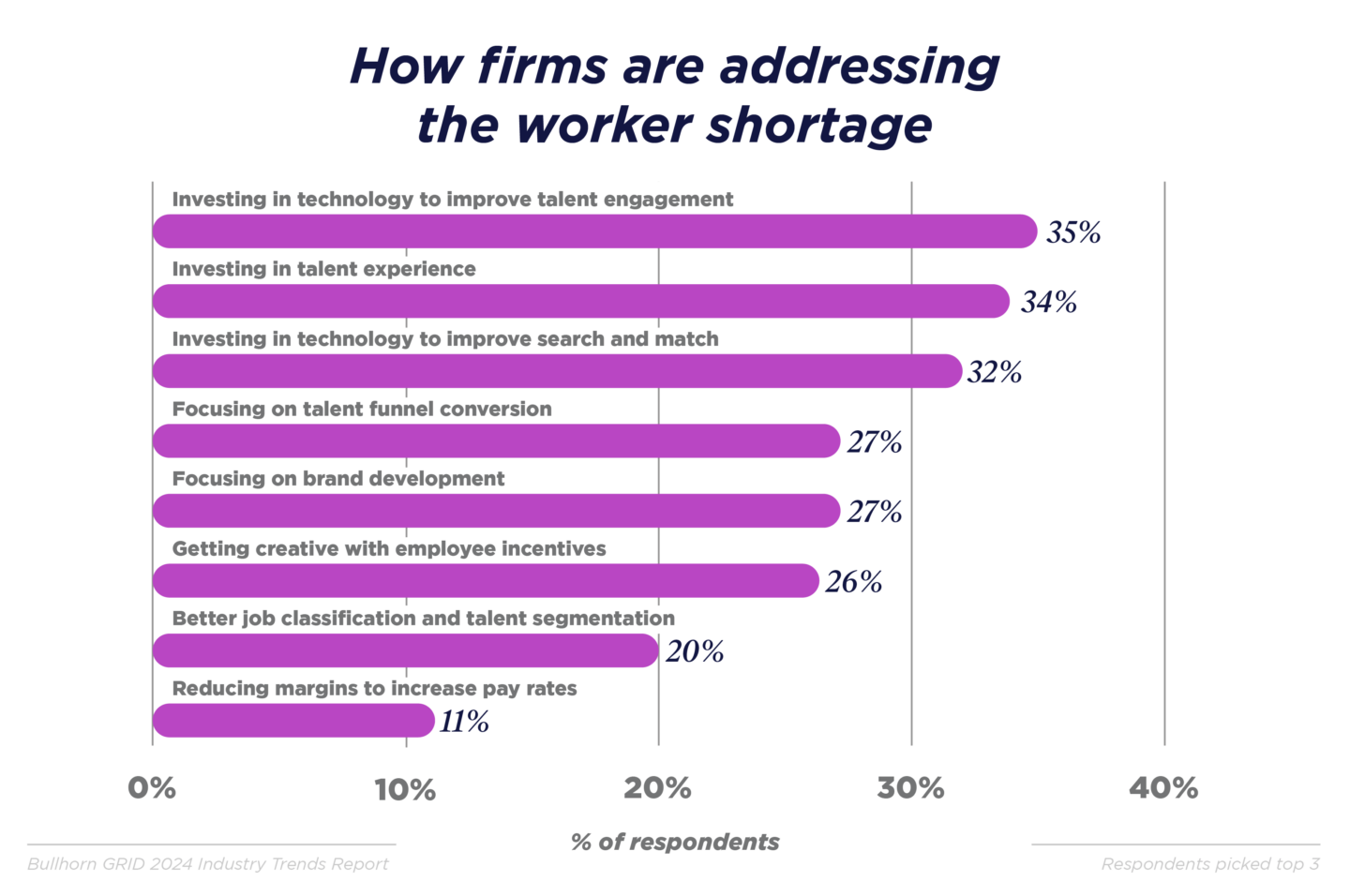

The top three strategies for addressing the worker shortage are all focused on improving the experience and moving workers through the funnel faster to place them in the right jobs more quickly. Speed is of the essence, particularly in LI. In fact, firms that place workers in less than 20 days were nearly 20% more likely to have seen revenue growth in 2023.

Unfortunately, nearly one-third of firms say that waiting is the biggest point of friction in the worker experience, which is why so many firms are leaning into technology and automation as the tool of choice to enhance the experience and things like search and match.

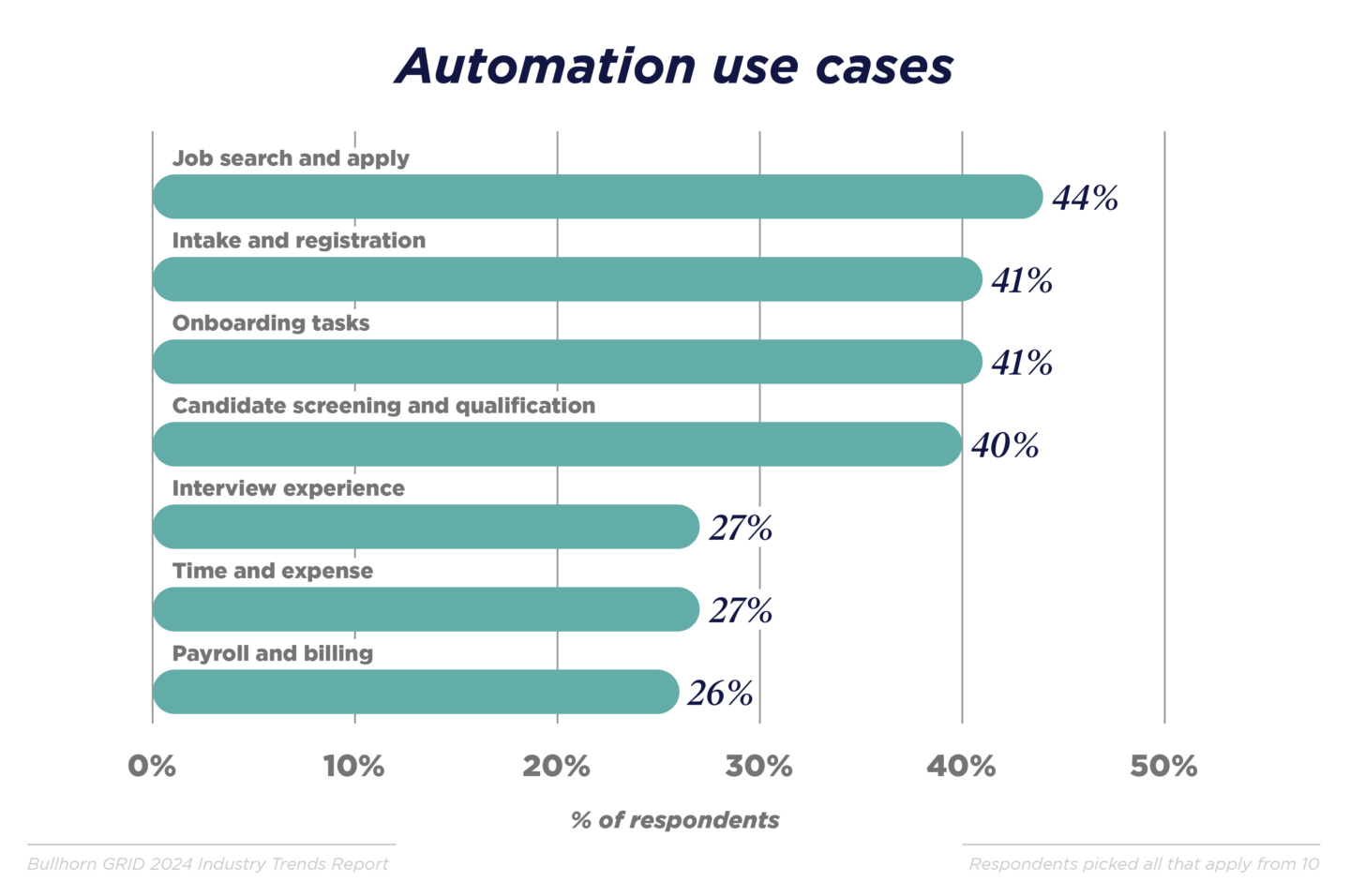

Firms are focused on enhancing the worker experience through automation

The top tasks LI firms are automating are job search, intake, onboarding, and candidate screening. These very much reflect the kinds of tasks that enhance the worker experience and move workers through the funnel faster and more efficiently. And the impact can be seen in the bottom line — firms that increased their revenue in 2023 were 26% more likely to have automated candidate screening and 18% more likely to have automated job search functionality.